FormulaMod Official Store

Notes On The New EU VAT Rules And VAT Pre-payment

Notes in advance:

1. This note is only for customers in EU countries.

If the recipient of the order is not in an European Union country, then the new EU VAT rules will not affect the order.

2. The VAT pre-payment mentioned in this note is only for the order total product value (excluding shipping cost) is less than EUR 150

*Regardless of the total order value, if you choose express logistics such as DHL, Fedex, etc. and some part of small package logistics such as ePacket, they default to DDU mode (Delivered Duty Unpaid), so VAT pre-payment is not required

For the order total product value over EUR 150, it will be sent in DDU mode (Delivered Duty Unpaid).

3. VAT pre-payment is an effective method and recommended by EU customs. It will be faster and easier to pass customs, reducing the occurrence of delays

If you have any questions about this, you can check the documents related to the new VAT rules provided by the European Union.

Suggested steps for VAT pre-payment self-service payment:

1) First submit a normal order for all the products you need,

Let's assume this [Order A]

Product value: $100

Shipping cost: $20

Discount/coupon: -$5

Oder total: $115

2) When [Order A] is submitted and paid successfully, go back to the order to see the value of the order product $100

At this time, there is a discount/coupon - $5, you can subtract this amount.

In other words, the final product value $95

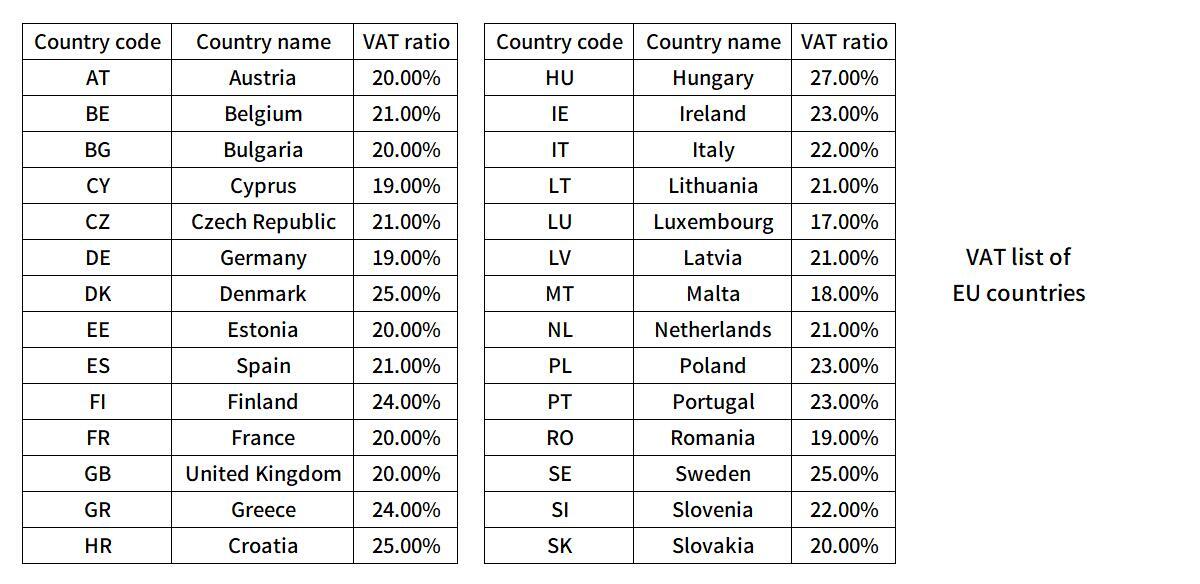

3) Check the VAT ratio of your country,

Let's assume [France], according to the table, France is 20%

Then the final product value x VAT ratio = VAT pre-payment.

$95 x 20% = $19

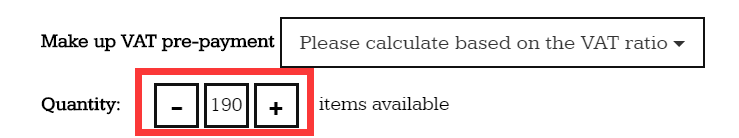

4) Submit a VAT pre-payment order by this link [Order B]

Put in 190 unit (since 1 unit = $0.1), total $19

5) In the end, a total of two orders

[Order A] for Product, $115

[Order B] for VAT pre-payment, $19

Done.

About the new EU VAT rule

The main impact of the new VAT rules on the packages:

The VAT exemption for the importation of goods of a value not exceeding EUR 22 will be removed.

As a result, all goods imported to the EU will be subject to VAT.

How it work:

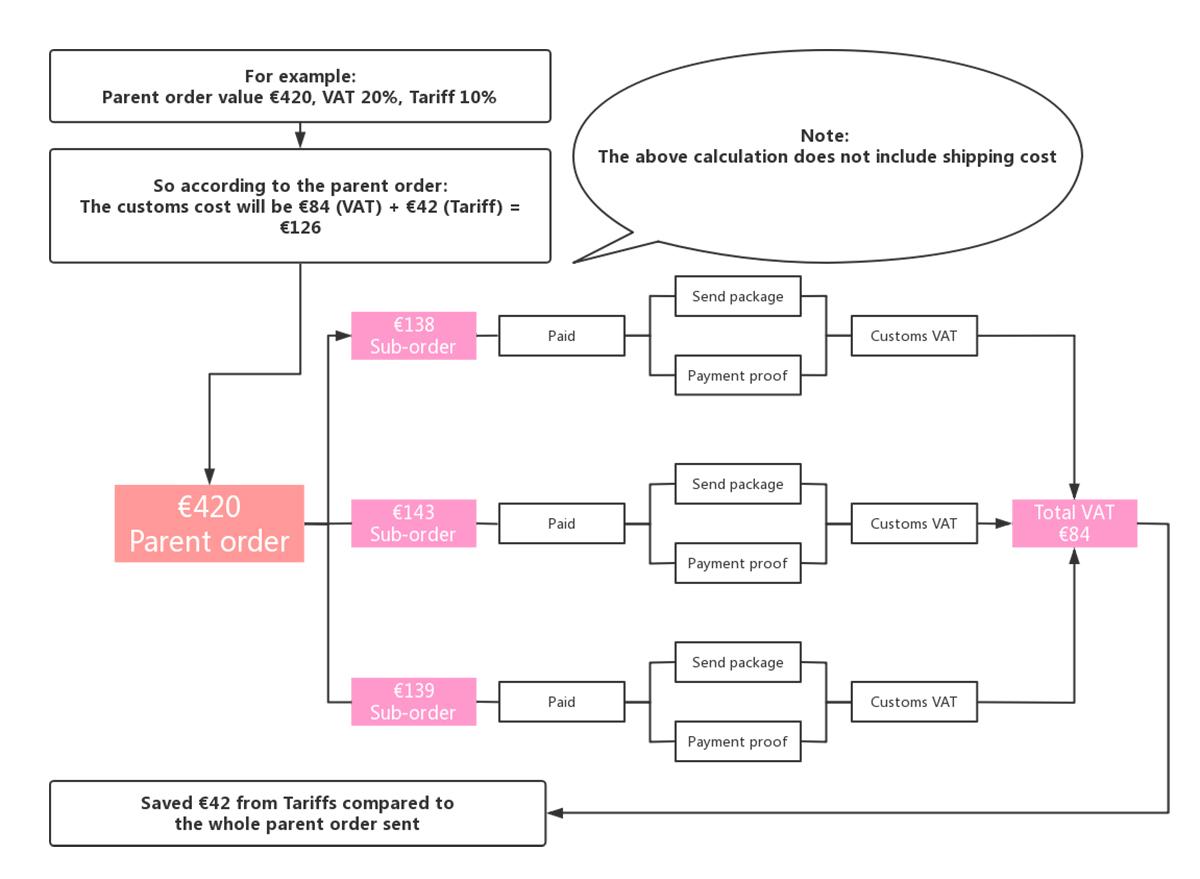

①When the package value is less than EUR 150,

the package will only be charged VAT.

②When the package value is higher than EUR 150,

the package will be charged VAT + Tariff.

Suggestions from FormulaMod:

We recommend that the product value of a single package should be controlled to less than EUR 150 as much as possible

So that this package will not be charged Tariff.

Since VAT is a fixed ratio, for the customs cost (in same total product value situation)

Generally speaking, multiple packages less than EUR 150 will be lower than one package in full product value higher than EUR 150

About VAT pre-payment

What is VAT pre-payment:

When a package with product value of less than EUR 150 arrives at the customs of EU countries.

The customs will propose to collect VAT according to the value of the package.

At this time, if this package has already pre-prepared the VAT cost in advance, then the package can be passed quickly without requiring documents or other certification from the recipient or sender.

This pre-prepared VAT cost is VAT pre-payment

How to calculate:

According to the VAT list of EU countries, we can already calculate the VAT price after confirming the order

VAT pre-payment application scope:

The order total product value (excluding shipping cost) is less than EUR 150.

Why need VAT pre-payment:

Since most of the current logistics methods for less than EUR 150 packages, they all belong to the DDP mode (Delivered Duty Paid) for EU countries.

Therefore, VAT pre-payment needs to be charged in advance to be allowed to ship and as a EU customs requirement.

In response to the new EU VAT rules, our FormulaMod team has not adjusted the price and shipping cost of any products for the fairness of all customers.

Instead, we will collect VAT pre-payment for EU customers before sending the package.

And then transfer this VAT pre-payment to the logistics company, so that this package can be sent smoothly and passed the EU customs.

Therefore, customers in EU countries, if the value of your order is less than EUR 150,

Please pay it by yourself according to the VAT ratio (by this link) or contact us for help.

So that we are able to arrange the sending of your package as soon as possible.

Thank you for reading and cooperating with the new rules :)

FomulaMod

Update 2022/3/25